20 on annual earnings above. To recommend the rate of interest for the year 2016-17 the status of estimated amount to the credit of the members as on 01042016 budget estimates BE of the Contributions and Withdrawals during 2016-17 and the estimated income from the investment holdings are taken into consideration.

Epf Interest Rates 2022 Epfo Cuts Interest Rates From 8 5 To 8 1

2016 to 2017.

. EPF contribution is made in two parts every month-Employers contribution The employer contributes a total of 12 of the employees dearness allowance and basic salary to the following-833 to the Employees Pension Scheme EPS367 to the Employees Provident Fund EPF050 to the Employees Deposit Linked. 060 On total employees and employers contributions payable 8. Total tax you should pay.

Under Full Employer Graduated Employee contribution rates FG Employees Age Years Employees total wages for the calendar month Total CPF contributions Employers Employees share Employees share of CPF contributions 55 below 500 to 750 50 Nil Nil 50 to 500 17 TW Nil 17 TW 015 TW - 500 750. Total EPF contribution every month 1800. Employers contribution towards EPS 833 of Rs 50000 Rs 4165.

The contributions made by employer and employee towards the EPF. Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HO No. 1208505001 1336 AbbasPS 17th March 2016 From India Bangalore.

Employer contribution is 12 on employee salary. 01011963 to 30091964 075 On total employees and employers contributions payable 625. Contribution By Employer Only.

5 rows The employees contribution rate is reduced 3 per cent from 11 per cent to 8 per cent. New EPF Contribution 8 YA 2017. 212 per week 917 per month 11000 per year.

Government officials have indicated that the Rs 15 lakh cap on employers contribution may be scrapped and tax on withdrawal limited to interest accrued on the corpus from the next financial year. 01111952 to 31121962 075 On total employees and employers contributions payable 625. 2274897 - 2274897 - LC.

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Total contribution in EPF account. 13 Ref Contribution Rate Section A Applicable for ii and iii only Employees share.

367 Employees Pension scheme AC 10 0. KUALA LUMPUR 28 January 2016. Statutory rate now changed to 8 Employee EPF contribution RM 6600 8 RM 528 Note.

Ref Contribution Rate Section E RM5000 and below. The year in which the new pf rate for employees is noted stays valid for the next financial year. Annual General Transfer AGT 2022 - Calling for online options through the HR-Software logins of officers.

Payroll from Jan till Feb 2016 will be calculated at 11 as below. 001 or min Rs. An additional RM210 in tax.

Employee who opt for 11 as Personal option. The EPF interest rate for FY 2018-2019 is 865. 12 Ref Contribution Rate Section A.

Till now withdrawal of EPF corpus after 5 years of continuous service was fully tax exempt. The FY 2021-22 EPF interest rates are as per the date March 12 2022 EPF Contribution Rate FY 2021-22. WSU612019Income TaxPart-I E-333064581 dated 06042022 78MB 6.

In addition to this Employer has to pay 085 as admin charge 05 as EDLI and 01 as EDLI admin charges. Old EPF Contribution 11 New EPF Contribution 8 YA 2016. Reduction in Employees EPF Statutory Contribution Rate 2016 The EPF Board Malaysia has announce a decrease of Employee Contribution Rate from 11 to 8 while for Senior Citizen it will be changed from 55 to 4.

Jaitley proposed in his Budget that 40 of withdrawals from National Pension Scheme NPS would be tax free and sought to bring EPF on a par with this. Currently the EMPLOYER has a set rate of 12 each month that MUST be sent to your EPF account. Wages up to RM30.

01101964 to 310798 009 On total pay on which contributions are payable. In 2016 the government has decided to reduce the EMPLOYEE contributions down to 8 hence you will end up with 3 more in your payslip each and every month. Employee Contribution to EPF.

Payroll from March 2016 onwards will be calculated at 8 as below. Employees Deposit linked insurance AC 21 0. Here are a few knowledge points to know about EPF.

65 Ref Contribution Rate Section C More than RM5000. Employers contribution towards EPF 367 of Rs 50000 Rs 1835. Following Prime Minister YAB Datuk Seri Najib Tun Abdul Razaks announcement during the presentation of the revision of Budget 2016 today the Employees Provident Fund EPF announces the reduction in the employees monthly statutory contribution rate from 11 to 8 for members below age 60 and 55 to 4 for those age 60.

The interest rate of EPF for FY 2021-22 is 810. When wages exceed RM50 but not RM70. How much is the EPF Contribution.

The new provisions indicates that if the EPF is not used for buying an annuity then 60 of that portion of the corpus which is built from the. Delimit IT0196 to use Personal Rate 11 01032016 onwards as below. 500- EDLIS Administrative charges AC-22 0.

This include 833 contribution to Pension Scheme. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. Employees contribution towards EPF 12 of 15000 1800.

In 2015 you as the EMPLOYEE would have 11 of your salary deducted. Employer contribution Employee provident fund AC 1 12. When wages exceed RM70 but not RM100.

When EPFO notifies the interest rate for a financial year that year-end the interest rate is calculated by the month-wise closing balance and later for the entire year. Prima facie the Budget 2016 has proposed making 60 of employee contribution EPF corpus taxable for contributions after 142016. When wages exceed RM30 but not RM50.

Lets use this latest EPF rate for our example. 050 EPF Administrative charges AC 2 0. Payroll from Jan till Feb 2016 will be calculated at 11 as below.

065 From 01042017 Previous-085 from Jan 2015 or min Rs.

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

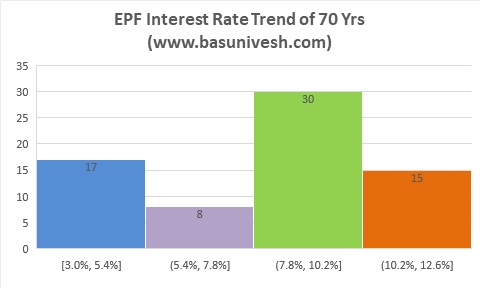

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Epf Interest Rate From 1952 And Epfo

Summary Of Case Study On Employee Provident Fund Of Malaysia

Confluence Mobile Community Wiki

Pin On Excel Utility To Prepare Ecr Ii

Tax Shield Your Retirement Corpus Tax Corpus Retirement

Confluence Mobile Community Wiki

Epf Interest Rate From 1952 And Epfo

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Tax On Epf More Options In Nps How Your Retirement Kitty Changed In 2021

Epfo 60 Days Productivity Linked Bonus For The Year 2017 18 Productivitylinkedbonus Plb Bonus2018 Bonus Epfo Efobonus Productivity Employee Bonus

How Epf Employees Provident Fund Interest Is Calculated

Confluence Mobile Community Wiki

Epf Interest Rate From 1952 And Epfo

Confluence Mobile Community Wiki

Confluence Mobile Community Wiki

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

Income Tax Ppt Revised Income Income Tax Tax